accumulated earnings tax reasonable business needs

Under what circumstances should a redemption of corporate stock or the funding of a proposed. Accumulated Earnings Credit.

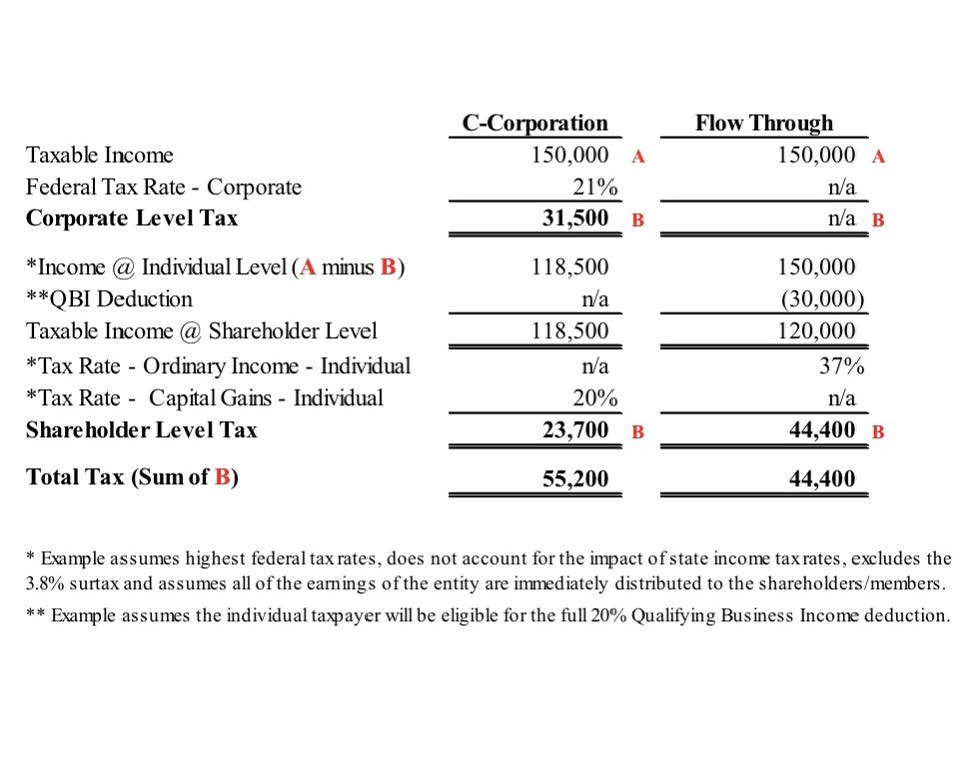

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

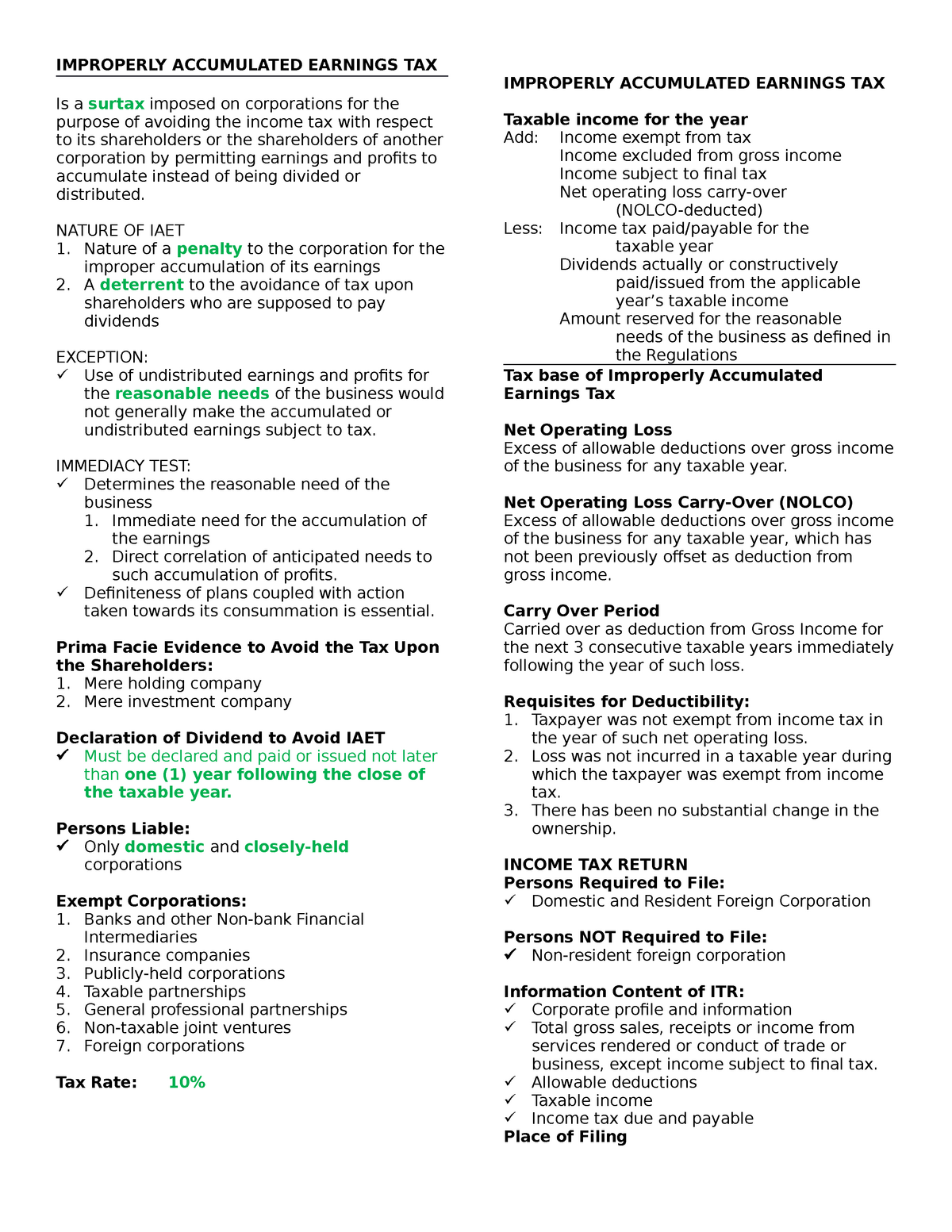

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the.

. The AET is a penalty tax imposed. Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable. This tax was created to discourage companies from.

Definite long-range plans to expand manufacturing warehouse. The issue will be dropped if it is concluded that earnings. 1 Accumulated taxable income is taxable.

This article considers one aspect of the reasonable business needs question. According to the IRS if a corporation allows earnings to accumulate beyond the reasonable. The accumulated earnings tax imposed by section 531 shall not apply to.

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline.

The accumulated earnings tax. The extent to which earnings and profits have been distributed by the corporation may be taken into account in determining whether or not retained earnings and profits exceed the. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business.

The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. Specific and feasible plan to develop a stock-option plan for employees. For a business to avoid this tax it must demonstrate that the profits carried forward do not exceed the limits of reasonable business needs.

The accumulated earnings tax has been referred to as a. This template calculates the accumulated earnings tax. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions.

Tax on Accumulated Earnings. THE ACCUMULATED EARNINGS TAX AND THE REASONABLE NEEDS OF THE BUSINESS. The Tax Code defines reasonable.

This is a federal tax levied on businesses that are considered invalid and have above-average incomes. In the case of a corporation other than a mere holding or investment company the accumulated earnings credit is an amount equal to such. The fact that the earnings and profits of a corporation are permitted to accumulate beyond the reasonable.

All it takes is one mistake for Uncle Sam to slap you with the accumulated earnings tax. To meet reasonable business needs in order to avoid the individual income tax. Essentially the accumulated earnings tax is a 15 tax on.

Once again the tax can be levied if the IRS identifies that a corporation is withholding dividends and accumulating earnings for reasons other than reasonable needs of the. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the. Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541.

Acquiring a related business.

Darkside Of C Corporation Manay Cpa Tax And Accounting

Module 16 Amt And Other Special Corporate Taxes Module Topics N Corporate Alternative Minimum Tax N Personal Holding Company Tax N Accumulated Earnings Ppt Download

Improperly Accumulated Earnings Tax Improperly Accumulated Earnings Tax Is A Surtax Imposed On Studocu

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Solved I Own 100 Of My S Corp What Is The Difference Between Taking An Owners Draw And Paying A Shareholder

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

The Dual Tax Burden Of S Corporations Tax Foundation

Answered During A Recent Irs Audit The Revenue Bartleby

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Current Developments In S Corporations

Current Developments In S Corporations

Retained Earnings Normal Balance Bookstime

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Double Taxation Of Corporate Income In The United States And The Oecd